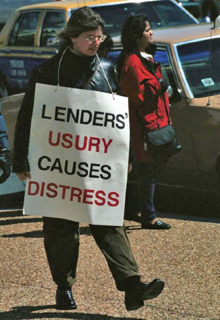

Let's say you want to buy a house and go the bank and get a loan. Say 200k. The simple truth is, after thirty years you will have payed back 600k. 200k for the principal and 400k (!!) in interest.

Let's say you want to buy a house and go the bank and get a loan. Say 200k. The simple truth is, after thirty years you will have payed back 600k. 200k for the principal and 400k (!!) in interest.

Now this might be ok, or at least somewhat understandable, if you were borrowing this money from somebody else, who has been saving it. But as we know, this is not the case. The money is produced the moment the loan is granted by the bank. In a computer program. By pressing a few buttons.

So basically you pay 400k interest for pressing a button. Granted, the bank needs to manage the loan during the time it is being repaid. But the cost for this is still only a fraction of the income they get through the interest.

When the bank creates some money by giving you a loan, it takes the money out of circulation when you repay. Repaying debts means a diminishing money supply. The banks only provide the principal, in our previous example 200k. But after thirty years, 600k has been repaid and only 200k was created. So how can this be? How can 600k be repaid by 200k?

It can't. Somebody else needs to get into debt to create sufficient liquidity to pay the 400k interest. And the borrower of the original loan must start competing for this liquidity with everybody else to obtain that, intrinsically scarce, cash.

This means that because of the combination of debt and interest, the money supply must grow forever. But we know that a growing money supply is the definition of inflation and that inflation is closely linked to rising prices.

So inflation is inherent in the system. This sounds strange, because Central Banks raise interest rates to lower inflation, reasoning less credit will be issued because of rising prices for it. But the higher the interest rates go, the more money must be created to pay for this interest.

Over the last year, US corporate leaders have often explained layoffs by saying the positions were...

Over the last year, US corporate leaders have often explained layoffs by saying the positions were... United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...

United Parcel Service on Tuesday said it would cut up to 30,000 operational roles in 2026,...