Thousands of documents detailing $2 trillion (£1.55tn) of potentially corrupt transactions that were washed through the US financial system have been leaked to an international group of investigative journalists.

The leak focuses on more than 2,000 suspicious activity reports (SARs) filed with the US government’s Financial Crimes Enforcement Network (FinCEN).

Banks and other financial institutions file SARs when they believe a client is using their services for potential criminal activity.

However, the filing of an SAR does not require the bank to cease doing business with the client in question.

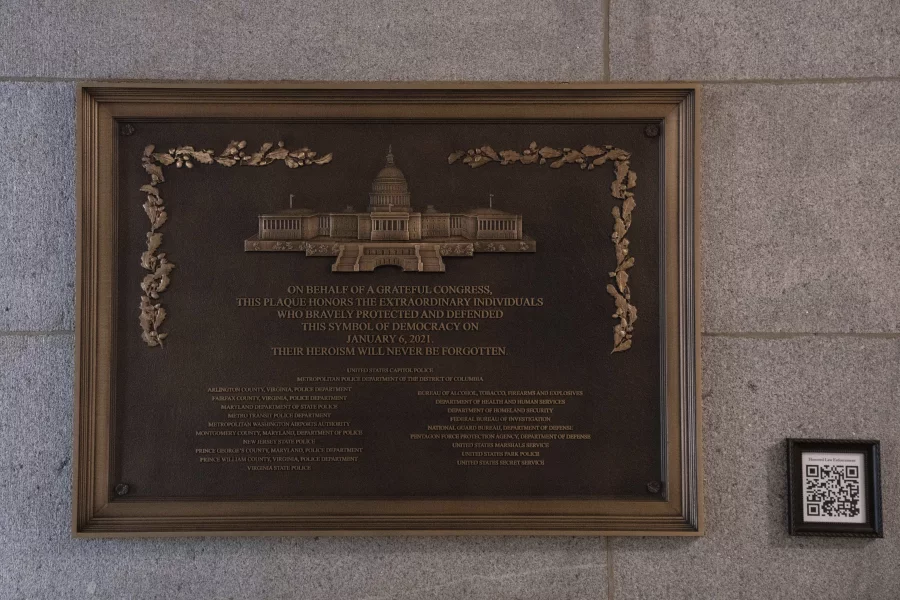

Visitors to the U.S. Capitol will now have a visible marker of the siege there on...

Visitors to the U.S. Capitol will now have a visible marker of the siege there on... The executive director of the National Symphony Orchestra, a mainstay at the Kennedy Center, is leaving...

The executive director of the National Symphony Orchestra, a mainstay at the Kennedy Center, is leaving... Four Democratic attorneys general, sitting in their offices from New York to California with state flags...

Four Democratic attorneys general, sitting in their offices from New York to California with state flags...