Procter & Gamble will cut up to 7,000 jobs, or approximately 6% of its global workforce, in the next two years as the maker of Tide detergent and Pampers diapers wrestles with tariff-related costs and customers who have grown anxious about the economy.

Procter & Gamble will cut up to 7,000 jobs, or approximately 6% of its global workforce, in the next two years as the maker of Tide detergent and Pampers diapers wrestles with tariff-related costs and customers who have grown anxious about the economy.

The job cuts, announced at the Deutsche Bank consumer conference in Paris on Thursday, make up about 15% of its current non-manufacturing workforce, said chief financial officer Andre Schulten.

“This restructuring program is an important step toward ensuring our ability to deliver our long-term algorithm over the coming two to three years,” Schulten said. “It does not, however, remove the near-term challenges that we currently face.”

Procter & Gamble to cut up to 7,000 jobs amid economic and tariff pressure

CFTC leaders exit as Trump pick prepares to take helm

In a series of departures announced in a matter of weeks, the agency’s entire top rung is set to turn over as Brian Quintenz, President Trump’s nominee for CFTC chair, prepares to take the reins.

Commissioners Summer Mersinger and Christy Goldsmith Romero both plan to depart by the end of the week, while fellow Commissioner Kristin Johnson has said she will leave “later this year.”

Acting CFTC Chair Caroline Pham has promised to remain at the agency until Quintenz is confirmed, at which time she too will depart. The commission, which typically has five members, has been short one person since former Chair Rostin Behnam stepped down in January.

The relatively low-profile agency is expected to play a key role in regulating the digital asset market alongside the Securities and Exchange Commission (SEC).

Trump administration says 5.3 million student loan borrowers will have wages garnished this summer

The garnishments will happen in waves, with the first borrowers seeing the pay deductions in early June. Monday, the Education Department started sending 30-day notices to around 195,000 defaulted borrowers to notify them that they will be subject to the Treasury Offset Program, which collects past-due debts owed to state and federal agencies. Under this program, Treasury can withhold money including tax refunds, wages, Social Security payments, and disability benefits to pay delinquent debt.

Later this summer, "all 5.3 million defaulted borrowers will receive a notice from Treasury that their earnings will be subject to administrative wage garnishment," the department says in its first timeline of the enforcement action.

Trump tariffs live updates: China retaliates with 34% tariff as Trump digs in, vows to 'never change' policies

President Trump has played down the shock impact of his tariff shift on markets, which kept spiraling downward on Friday as fears for the global economy grew.

US trading partners have vowed to retaliate after Trump ended months of suspense on Wednesday by revealing broad reciprocal duties on all countries, in what he has referred to as "Liberation Day." On Friday, China announced it will impose countermeasures against the US starting April 10, including a 34% tariff on US goods.

Trump's administration is imposing a baseline tariff of 10% across all countries beginning at 12:01 a.m. on Saturday. The US is upping those duties for various partners whom he described as bad actors starting next Wednesday, April 9.

Trump vowed to "never change" his policies on Friday, even as he touted progress with Vietnam, a country set to see one of the biggest US tariff hits.

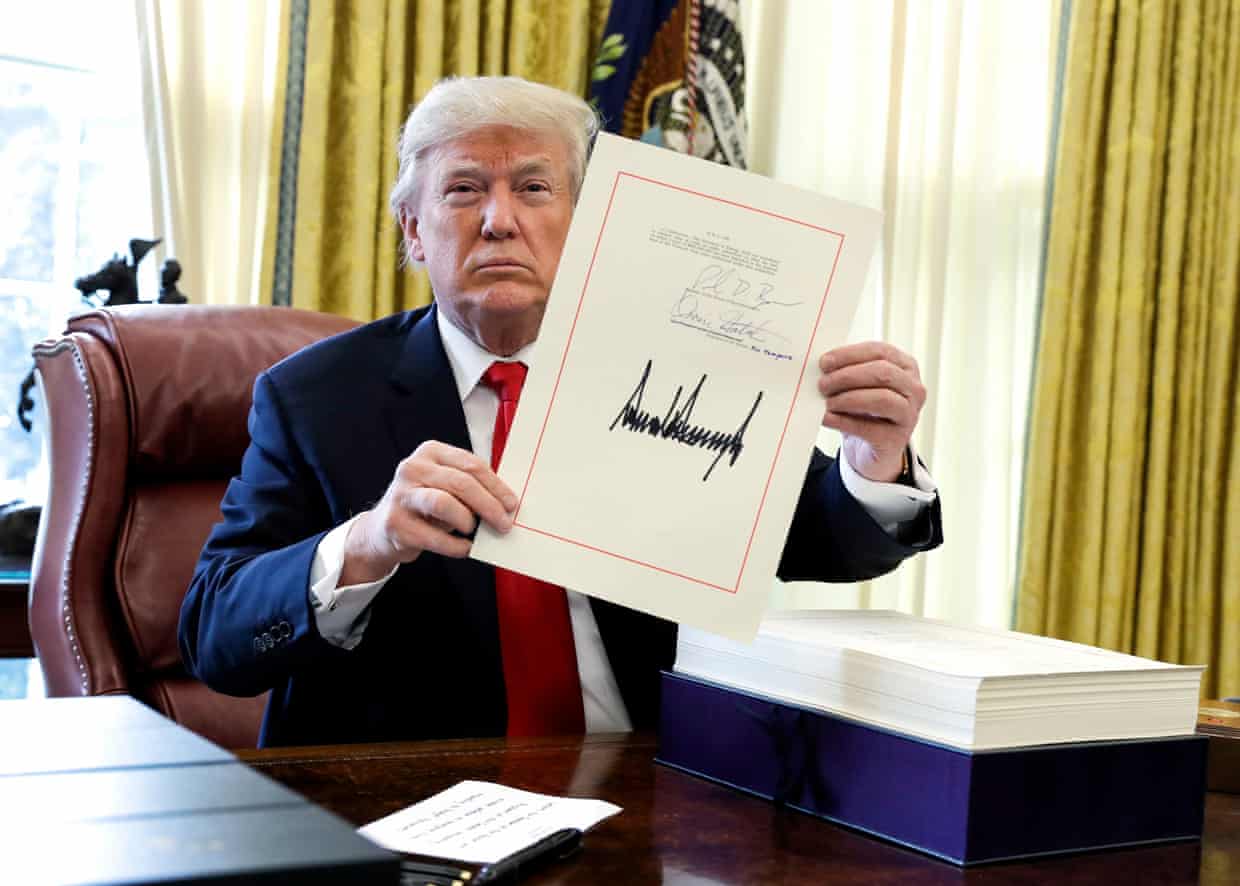

US corporations push to roll back Trump-era tax policies they once endorsed

US corporations and their supporters in Washington are pushing aggressively to roll back tax policies they once endorsed, in a move that could return hundreds of billions of dollars to some of America’s biggest companies.

As congressional negotiators attempt to keep the government funded past 19 January, an agreement is emerging that ties the corporate tax breaks to an increase in support for vulnerable American families – an effort to make the deal more palatable for Democrats.

Just six years ago the Business Roundtable, a lobbying group for CEOs of large US firms, described the Trump-era Tax Cuts and Jobs Act as “a remarkable, once-in-a-generation opportunity”. Now, the group is leading “a six-figure advocacy campaign” to roll back parts of it, according to Politico, and threatening that failing to secure new tax cuts will lead to “slower job creation, smaller wage increases and lower overall economic growth”.

Crypto exchange FTX files for bankruptcy amid $8 billion shortfall

FTX Trading on Friday filed for Chapter 11 bankruptcy, capping a sudden and startling downfall for one of the world's largest cryptocurrency exchanges.

Founder and CEO Sam Bankman-Fried also resigned from the company, which appointed John J. Ray III as its new chief executive. Bankman-Fried plans to stay with FTX while it works through the bankruptcy process, according to a statement on Friday.

"The immediate relief of Chapter 11 is appropriate to provide the FTX Group the opportunity to assess its situation and develop a process to maximize recoveries for stakeholders," Ray said in the statement.

How Fed's bigger, faster rate hikes will affect your credit card, mortgage, savings rates

The central bank is considered likely to raise its benchmark short-term rate by three-quarters of a percentage point, far larger than the typical quarter-point increase, to a range of 1.5% to 1.75%. It will also likely forecast additional large rate hikes through the end of the year.

A series of sizeable increases would heighten borrowing costs for consumers and businesses, likely leading to an economic slowdown and raising the risk of a recession. The Fed's previous rate hikes have already had the effect of raising mortgage rates roughly 2 percentage points since the year began and have slowed home sales.

More Articles...

Page 4 of 70

Economic Glance

Economic Glance