Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes on the super-rich, amid growing concern that the wealthiest in society are buying political influence.

Nearly 400 millionaires and billionaires from 24 countries are calling on global leaders to increase taxes on the super-rich, amid growing concern that the wealthiest in society are buying political influence.

An open letter, released to coincide with the World Economic Forum in Davos, calls on global leaders attending this week’s conference to close the widening gap between the super-rich and everyone else.

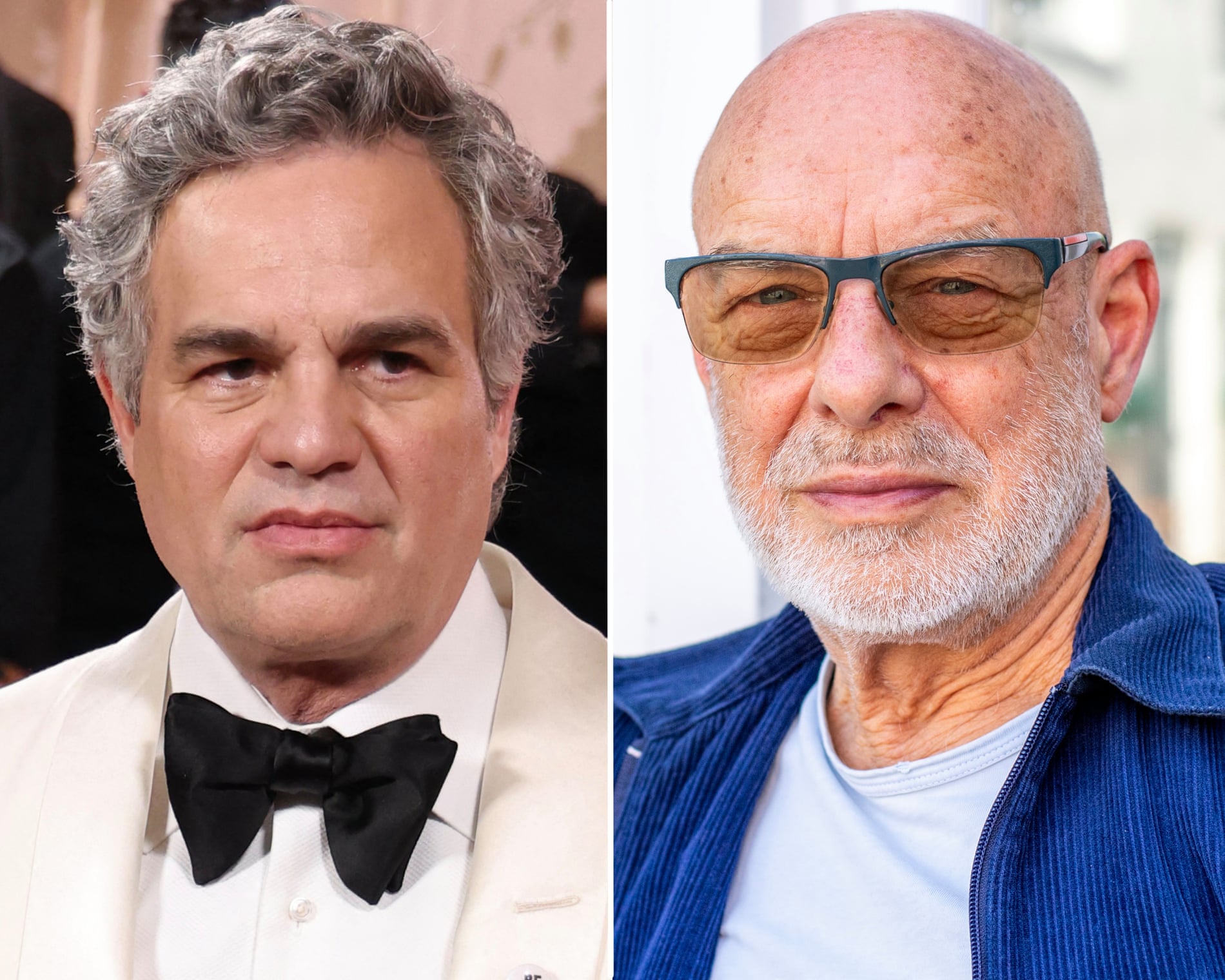

The letter, signed by luminaries including the actor and film-maker Mark Ruffalo, the musician Brian Eno and the film producer and philanthropist Abigail Disney, says extreme wealth is polluting politics, driving social exclusion and fuelling the climate emergency.

"A handful of global oligarchs with extreme wealth have bought up our democracies; taken over our governments; gagged the freedom of our media; placed a stranglehold on technology and innovation; deepened poverty and social exclusion; and accelerated the breakdown of our planet,” it reads. “What we treasure, rich and poor alike, is being eaten away by those intent on growing the gulf between their vast power and everyone else.

Economic Glance

Economic Glance There is a new deadline for U.S. importers to file for electronic refunds if the Supreme Court rules President Donald Trump’s IEEPA tariffs are illegal.

There is a new deadline for U.S. importers to file for electronic refunds if the Supreme Court rules President Donald Trump’s IEEPA tariffs are illegal. In the bowels of the US Federal Reserve this summer, two of the world’s most powerful men, sporting glistening white hard hats, stood before reporters looking like students forced to work together on a group project.

In the bowels of the US Federal Reserve this summer, two of the world’s most powerful men, sporting glistening white hard hats, stood before reporters looking like students forced to work together on a group project. Bank of America CEO Brian Moynihan says the headlines about Gen Z’s fears about AI and the job market are real.

Bank of America CEO Brian Moynihan says the headlines about Gen Z’s fears about AI and the job market are real.